|

Index

|

Q1 2025

|

YTD

|

|---|---|---|

|

S&P/TSX Composite (C$)

|

8.5%

|

10.2%

|

|

S&P 500 (US$)

|

10.9%

|

6.2%

|

|

S&P 500 (C$)

|

5.3%

|

0.7%

|

|

MSCI EAFE (US$)

|

11.8%

|

19.5%

|

|

MSCI EAFE (C$)

|

6.1%

|

13.3%

|

|

FTSE TMX Universe Bond Index (C$)

|

-0.6%

|

1.4%

|

|

C$ / US$

|

1.4376 to 1.3643 (5.4%)

|

1.4389 to 1.3643 (5.5%)

|

* Index returns are total returns, including dividends.

CLOUD COVERAGE

There’s an old saying attributed to the poet Carl Sandburg: “A fog is just a cloud that fell down.” Lately, the investment landscape feels much the same. On the one hand, the sun is out—for the most part, equity markets have climbed higher, consumer sentiment has improved, and economic indicators show resilience. But the fog has not fully lifted. Signs of strain persist across areas like consumer spending, credit, and corporate earnings. In a sense, we’re walking through low-lying cloud—visibility is limited, and we must be careful of our footing.

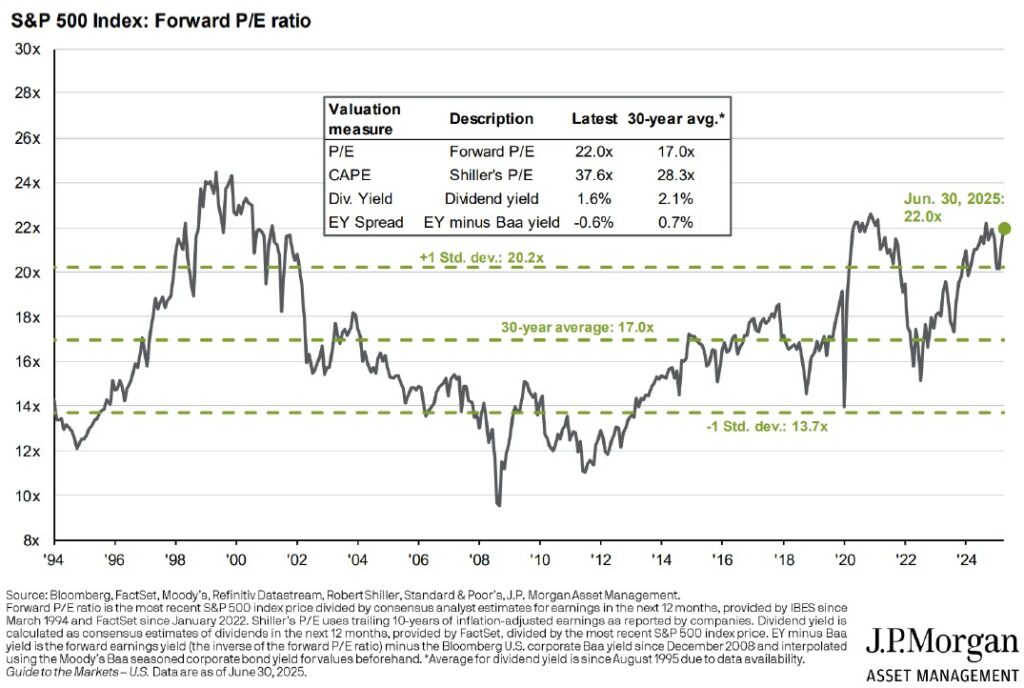

The S&P 500 recently touched new highs, and by some metrics, equities are as richly priced as they’ve been since 2021 (see chart below). The optimism is built on the narratives that inflation is under control, interest rates are peaking, and earnings growth is sustainable. This comes following an incredible drop and subsequent recovery of global markets fueled mostly by policy rhetoric coming out of the White House. Global tariff threats sent markets tumbling, and although these risks are not gone, sentiment is much more positive today than it was in March and April.

Narratives, however, can be fickle. Even as investors cheer soft landings, muted tariffs, and AIfueled growth, risks persist in the form of consumer credit stress, geopolitical instability, and tight liquidity. History reminds us that when expectations rise faster than earnings, disappointment tends to follow. Valuation doesn’t predict timing—but it can often predict outcomes.

And yet, there is another side to the story. Technological change—particularly, the rapid adoption of artificial intelligence and robotics—has proven to be much more than a short-lived fad. Across sectors, we’ve seen firms axe thousands of jobs while maintaining or even improving output. IBM cut 8,000 jobs in their back-office team while embracing AI-based automation, or Klarna, which claims to have replaced large portions of its customer support with AI tools to cut costs. It is worth noting that in both cases new employees needed to be hired to help provide good quality support. However, we could be seeing early signs of a structural shift in productivity. If so, long-term earnings growth could be unexpectedly strong, even if valuations today appear stretched.

Still: are investors extrapolating too far, too fast? Markets often lurch ahead of reality, pricing in perfection long before it arrives. We’ve seen this movie before—tech in 2000, housing in 2006, growth stocks in 2021. Like Icarus, markets can climb towards the sun on wings of enthusiasm, only to learn the hard way the limits of wax and feathers. Our role as stewards of your capital is, among other things, to know when the altitude is becoming dangerous.

In this fog of optimism and risk, discipline is our lighthouse. We remain focused on companies with durable cash flows, conservative balance sheets, and the capacity to weather different economic regimes; in short, businesses that don’t need clear skies to thrive. We are also trimming positions where valuations no longer reflect reasonable expectations and adding where quality is underappreciated. It is this careful balance—optimism without euphoria, caution without paralysis—that defines our investment approach.

To borrow from Hemingway, markets go awry “gradually, then suddenly.” The same could be said of innovation-led recoveries. It is too soon to say which direction we are headed—but either way, preparation matters more than prediction.

MAKING MOVES

1 Some clients may not hold UPS due to asset mix or timing.

OUR SENTIMENT ON CEMENT

As long-term investors, we treat selling with as much discipline as buying. We typically only trim or exit a position if the market price significantly exceeds our estimate of a company’s intrinsic value, or if the facts upon which our original investment thesis was based have changed. These are not decisions we take lightly. Patience is frequently rewarded in investing, and short-term noise rarely justifies a shift in conviction. But when the price offered by the market no longer reflects a compelling long-term return, it is our responsibility to redeploy capital more effectively elsewhere.

We first began building our position in Heidelberg Materials2 in 2019, attracted by the company’s strong competitive position in cement and aggregates, particularly in Europe and North America. At the time, valuations were depressed due to cyclical concerns, and we saw an opportunity to own a capital-intensive but strategically positioned business at a discount. Over the past two years, the company executed well—improving margins, reducing debt, and benefitting from pricing tailwinds in construction materials. As investor sentiment improved and the stock appreciated meaningfully, we reassessed it against our initial intrinsic value estimate.

When we first bought Heidelberg, the stock was trading at a forward price-to-earnings multiple of roughly 8x. In recent months that same multiple has increased to almost 14x on robust profits for the company and an increasingly bullish outlook for Germany’s fiscal expansion, which has more than offset fears from global trade tensions. As such, the margin of safety that initially justified our position has narrowed. While we continue to respect the company’s long-term growth prospects, the return profile at this current price point no longer meets our standards. With the stock trading above our estimate of fair value—and no real reason to revise that view upwards—we chose to exit our position. The sale reflects our disciplined approach: hold great businesses when value is on our side, and move on when it no longer is.

Thank you for your continued confidence and support.

The Evans Team