|

Index

|

Q1 2025

|

YTD

|

|---|---|---|

|

S&P/TSX Composite (C$)

|

12.5%

|

23.9%

|

|

S&P 500 (US$)

|

8.1%

|

14.8%

|

|

S&P 500 (C$)

|

10.3%

|

11.1%

|

|

MSCI EAFE (US$)

|

4.8%

|

25.1%

|

|

MSCI EAFE (C$)

|

6.9%

|

21.1%

|

|

FTSE TMX Universe Bond Index (C$)

|

1.5%

|

3.0%

|

|

C$ / US$

|

1.3643 to 1.3921 (-2.0%)

|

1.4389 to 1.3921 (3.4%)

|

* Index returns are total returns, including dividends.

THE SUPPORTING CAST

In every great film franchise, there comes a time when the spotlight must shift. Think of Star Wars, where the original heroes eventually handed the narrative over to a new generation; or Grey’s Anatomy, where familiar faces periodically exit, making room for emerging characters to carry the story forward. Security markets, in their own way, follow a similar path. The so-called “Magnificent Seven” have been the headliners for years. Their influence is enormous, their narratives compelling. Yet as every good director knows, even the stars of the show need a strong supporting cast to keep the story interesting and sustainable over the long term.

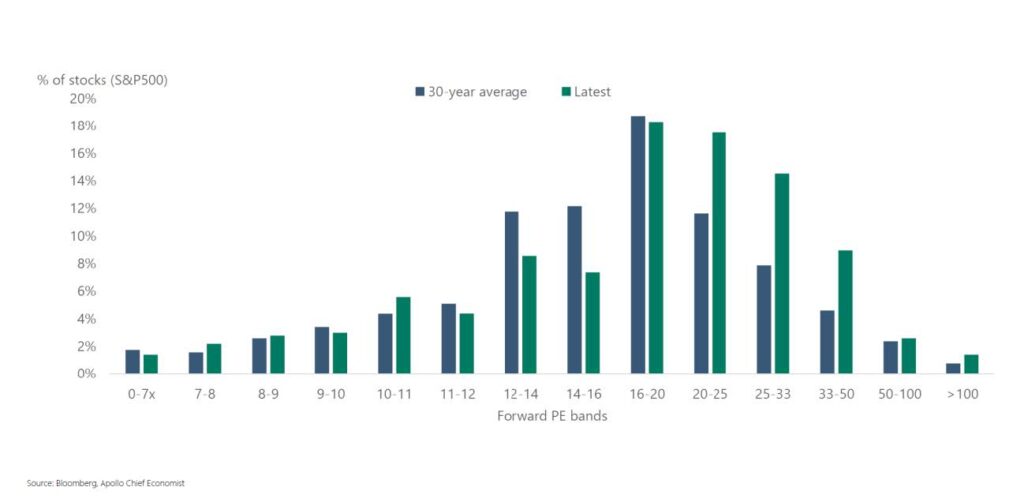

Equity markets once again proved remarkably resilient throughout the third quarter, extending the recovery that began in the spring following the turbulence surrounding tariff discussions in March and April. Despite ongoing concerns ranging from global trade friction to uneven corporate results, the markets continued to advance with surprising steadiness. Beneath the surface, however, some cracks are becoming visible: companies like Lululemon and UPS have delivered softer results than expected, reminding investors that consumer strength and global trade are not yet on perfectly stable footing. Rising U.S. debt levels and slowing industrial activity add further complexity. Neither the economy nor consumer sentiment is without their respective challenges, but the U.S. equity markets still seem optimistic, as showcased by the S&P 500 valuation levels (see chart below).

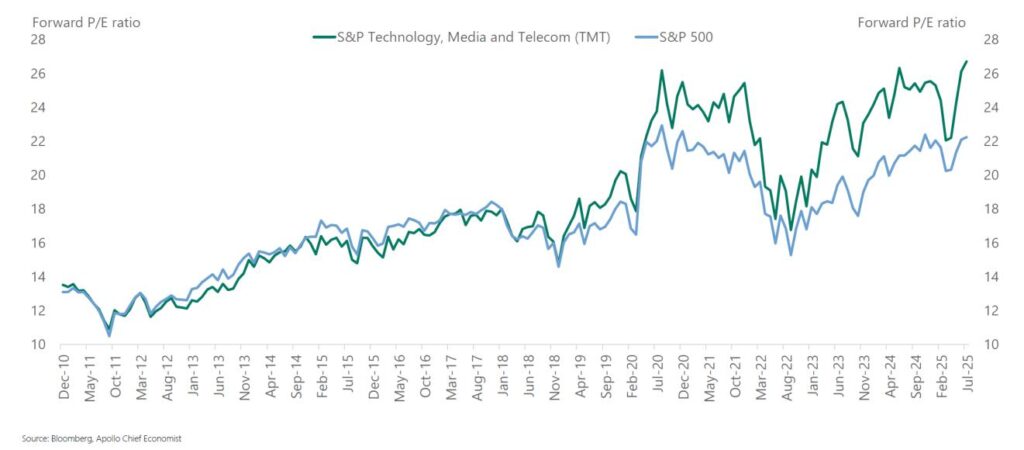

One of the most dominant storylines continues to be artificial intelligence (AI). Expectations and valuations around AI have expanded dramatically, underlining its promise as a transformative technology. We agree that AI will shape industries for years to come, but at the same time are cautious about assuming every company with an AI narrative will justify today’s lofty multiples (see chart below). Instead, we are seeking opportunities to participate in the story indirectly, where the supporting cast stands to benefit from the main plot’s momentum — for instance, in energy companies poised to gain from the immense power demand driven by data centers and computing growth. These are the “picks and shovels” that enable progress behind the scenes, often offered at much more reasonable prices than the obvious stars themselves, such as NVIDIA.

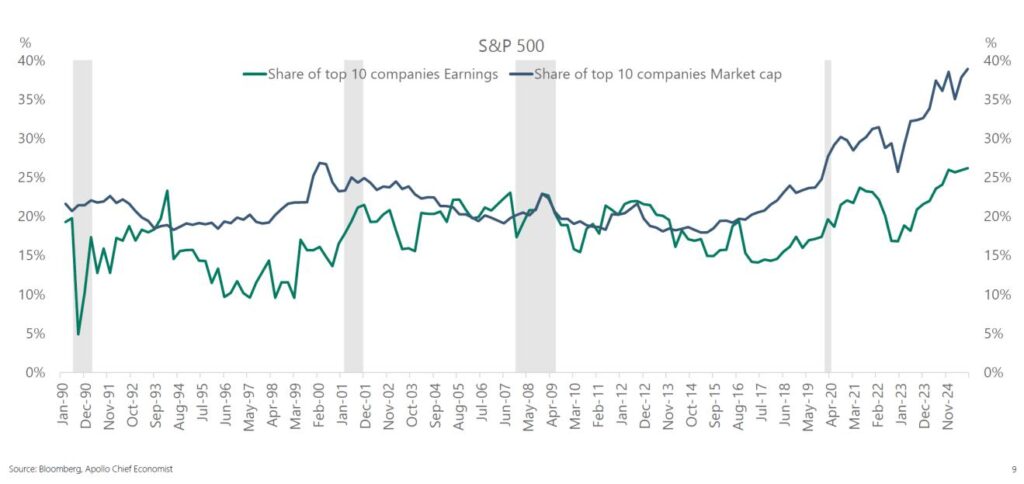

Meanwhile, market concentration has once again reached historic levels. The top ten companies in the S&P 500 account for nearly 40% of the index’s total market capitalization today, mirroring peaks seen in prior eras of technological excitement (see chart below). This concentration raises a simple but important question: just how diversified is a passive investor today? By owning the market, one is essentially making a large, U.S.-focused bet on a small number of high-growth technology names — the stars of the current franchise. While these companies remain formidable, history reminds us that star power rarely lasts forever and cultivating a supporting cast is vital to keep the franchise alive.

In our view, the resilience we are witnessing in the markets today reinforces the importance of staying grounded in valuation and balance. We continue to find opportunities, though it requires more selective searching than in recent years. Bonds, once offering rich yields, now demand greater scrutiny as credit spreads have tightened; equities require even more discernment as enthusiasm concentrates at the top. Our focus as always remains on durable businesses with sensible valuations — the strong, dependable performers who keep the narrative moving when sentiment shifts.

Just as the best films and TV shows endure because of the depth of their ensembles, we believe strong portfolios are defined not by a handful of superstars but by the quality and resilience of the supporting cast. Our job is not to chase the A-listers but to build a cast capable of performing across market cycles. Over time, it is a balanced cast full of supporting characters — steady, disciplined, and undervalued — that delivers the most enduring stories of success.

A HOME-GROWN SUPPORTING CHARACTER

Canadian National Railway (CNR) was created in 1919 through the consolidation of bankrupt rail lines Canadian Northern and Grand Trunk and then taken public in 1995. Over time, the company expanded into the U.S. through acquisitions, giving it a unique coast-to-coast Canadian network that also extended to the U.S. Midwest and the Gulf of Mexico. Today, it operates nearly 32,000 kilometres of track, moving a diverse range of goods including grain, forest products, metals, chemicals, petroleum, shipping containers, and automobiles.

CNR’s business model is built on high fixed costs, scale, and network density. Because bulk freight cannot easily shift to trucks or new rail companies, the barriers to entry are extremely high for any potential competitors. The company’s entrenched infrastructure, efficient scheduled operations, and strategic port access make it one of North America’s most defensible transportation assets. It has historically delivered strong returns on equity and disciplined capital allocation, underscoring the durability of its franchise.

Recently, CNR’s stock came under pressure when management cut its 2025 outlook. Volume softness in industrial commodities, trade and tariff uncertainty, and a stronger Canadian dollar have all weighed on earnings. Labour disputes and operating disruptions have also challenged performance. As a result, the company withdrew its 2024–26 financial outlook, and investors de-rated the stock from a forward-12-month price/earnings ratio of over 20x to just 16x. This has created a perception that the challenges are structural rather than cyclical. We see this as an overreaction.

In our opinion, CNR’s moat remains intact, and once volumes normalize, its high operating leverage means that incremental revenue should quickly expand margins. With a strong balance sheet, pricing power and essential infrastructure, the company is well-positioned to benefit disproportionately from a recovery in trade and industrial activity. At current levels, the stock trades below historical valuation averages, making it an attractive long-term investment opportunity to own a wide-moat company at a reasonable price.1

1 Some clients may not own CNR due to asset mix or timing.

SPREADS TIGHTENING

The Bank of Canada cut its overnight rate once again in the third quarter, to 2.5%. Yields on Canadian bonds remain quite low, reflecting expectations of a weakening economy and a continuing easing cycle ahead. While this provides some relief to borrowers, it has made the bond market a more challenging hunting ground for investors seeking value. Low yields and tightening credit spreads mean compensation for risk is now less attractive than it was earlier in the year. The chart below shows 5-year credit spreads between corporate and government bonds dropping (tightening) below one standard deviation from the 16-year average (1.3649%). This means fewer opportunities in the corporate bond market that meet our criteria for both value and risk-adjusted return.

We continue to look for opportunities, though finding them has become more challenging. We are actively considering provincial bonds, as their relative spreads remain somewhat more attractive compared to federal or high-quality corporate issues. We also continue to invest in select preferred shares where we deem the returns are sufficiently attractive relative to the additional capital structure risk. However, the overall current landscape is one in which care and patience in security selection are critical. With valuations less compelling across much of the bond market, we are emphasizing discipline and flexibility, recognizing that challenging periods like this frequently precede better opportunities down the road.

As always, we continue to approach the stewardship of your wealth with care and caution. We patiently wait for opportunities to add value, and pounce when we feel one presents itself. We continue to believe, as the long-time Vice Chairman of Berkshire Hathaway Charlie Munger once said, that “the best way to find a great partner is to deserve one.” We hope to continue to be deserving of your trust for many years to come.

Thank you for your continued confidence and support.

The Evans Team